Issue 11 is endorsed by FOP Lodge 57 and Firefighters Local 2380!

Highland Heights Property Taxes: What You Need to Know

For decades, income taxes funded over 80% of our city budget, allowing us to reliably maintain a very low property tax rate. That has been a reflection of our decades-long commitment to financial restraint. However, this model is inherently more unsustainable and riskier for a community like ours.

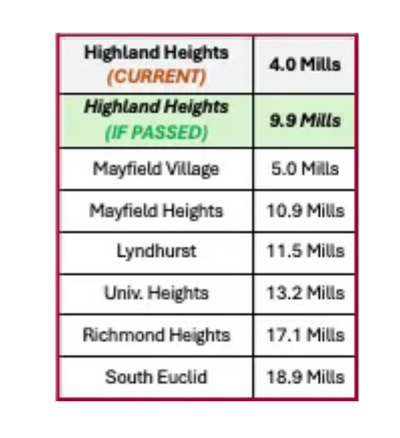

Currently, Highland Heights’ 4 mills property tax is the lowest among the major cities surrounding our community. If the levy is passed, WE WILL REMAIN THE LOWEST rate among our neighboring cities.

The 5.9 mill levy would cost approximately $17 a month per $100,000 of home value, or $206.50 annually. This is an investment that protects the high-quality Safety Services we pride ourselves on, keeping Highland Heights one of the region’s safest and most desirable communities.

More information available in the Safety Services Levy FAQ.

Highland Heights is still the lowest tax rate in the Hillcrest area after the levy passes.

Levy Will Give the City 2.5x What They Receive Today

Current Property Tax Distribution

Percentage based on $300k home - $2,822.20 per half

Post Levy Property Tax Distribution

Percentage based on $300k home - $3,104.44 per half

Citizens for Highland Heights PAC

763 Bishop Rd, Highland Heights, Ohio 44143| citizensforHH@gmail.com

Copyright © 2025 Citizens for Highland Heights - All Rights Reserved.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.